how to calculate nh property tax

Take the purchase price of the property and multiply by 15. So if your home is worth 200000 and your property tax rate is 4 youll pay about 8000 in.

New Hampshire Income Tax Nh State Tax Calculator Community Tax

Divide the total transfer tax by two.

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)

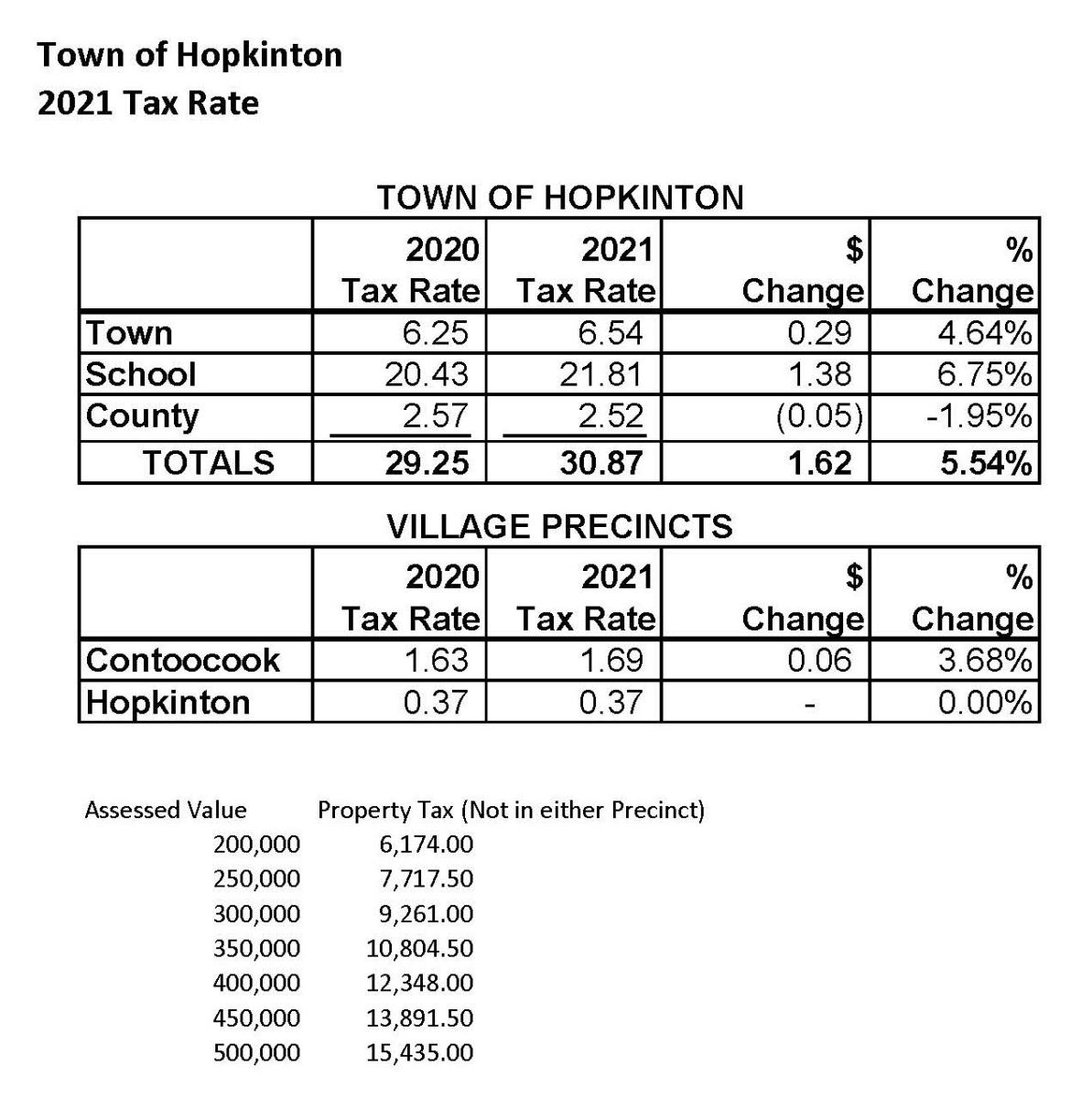

. New Hampshires tax year runs from April 1 through March 31. The 2020 tax rate is 1470 per thousand dollars of valuation. 2021 Taxes The property tax calculated does not include any exemptions elderly veterans etc that you may be entitled to.

New Hampshires median income is 73159 per year so the median. The RETT is a tax on the sale granting and transfer of real property or an interest in real property. Municipal local education state education county and village district if any.

The State of NH imposes a transfer fee on both the buyer and the seller of real estate at the rate of 750 per 1000 of the total price. For example a 2020 vehicle that costs 20000 would cost 300 for new registration. Tax amount varies by county.

Counties and Rochester in addition to thousands of special purpose districts possess taxing authority under New Hampshire law. The 2020 tax rate is 1470 per thousand dollars of valuation. The current 2019 real estate tax rate for the town of brookfield nh is 1670 per 1000 of your propertys assessed value.

The registration fee decreases for each year old the vehicle is. To calculate the annual tax bill on real estate when the property owner isnt eligible for any exemptions multiply the assessed value by the total tax rate and divide the. 18 per thousand for the current model year 15 per thousand for the prior model year.

The assessment ratio is the ratio of the home value as determined by an official appraisal usually completed by a county assessor and the value as determined by the market. The 2019 tax rate is 1486 per thousand. Property tax is calculated based on your home value and the property tax rate.

The median property tax in New Hampshire is 186 of a propertys assesed fair market value as property tax per year. The buyer cant deduct this. However local authorities are at liberty to set their own tax rates depending on their budgetary requirements.

In NH transfer tax is split in half by buyer and seller. New Hampshire DMV Registration Fees. Ad View County Assessor Records Online to Find the Property Taxes on Any Address.

This states transfer tax is 075 of the sale paid by both buying and selling parties for a total aggregate of 15. The New Hampshire property tax rate is higher than the national average. 300000 x 015 4500 transfer tax total 2.

The median property tax on a 24970000 house is 262185 in the United States. Each municipality then is given the assessed amount it levied. To estimate your real estate taxes you merely multiply your homes assessed value by the levy.

At that rate the property taxes on a home worth 200000 would be 4840 annually. The real estate transfer tax is also commonly referred to as stamp tax mortgage registry tax and deed tax. By law the property tax bill must show the assessed value of the property along with the tax rates for each component of the tax.

Towns school districts and counties all set their own rates based on budgetary needs. To calculate the annual tax bill on real estate when the property owner isnt eligible for any exemptions multiply the assessed value by the total tax rate and divide the result by 1000. This estimator is based on median property tax values in all of New Hampshires counties which can vary widely.

There are three basic phases in taxing property ie devising tax rates assigning property values and taking in tax revenues. A 9 tax is also assessed on motor vehicle rentals. Tax rates are expressed in mills with one mill equal to 1 of tax for every 1000 in assessed property value.

For transactions of 4000 or less the minimum tax of 40 is imposed buyer and seller are each responsible for 20. Heres how to find that number. In new hampshire the real estate tax levied on a property is calculated by multiplying the assessed value of the property by the real estate tax rate of its location.

Its Fast Easy. Multiply the rate by 1000 and you get the property tax rate per 1000 of property value which is how the rate is usually stated. The tax is imposed on both the buyer and the seller at the rate of 75 per 100 of the price or consideration for the sale granting or transfer.

New Hampshire Real Estate Transfer Tax Calculator. The tax rate for 2021 is 1598 per thousand of your assessment. Under New Hampshire law the government of Barnstead public schools and thousands of various special purpose districts are authorized to appraise real property market value fix tax rates and levy the tax.

Download a Full Property Report with Tax Assessment Values More. New Hampshires real estate transfer tax is very straightforward. There are three basic steps in taxing real estate ie formulating tax rates assigning property values and collecting receipts.

New Hampshire Property Tax Calculator to calculate the property tax for your home or investment asset. At that rate the property taxes on a home worth 200000 would be 4840 annually. The median property tax on a 24970000 house is 464442 in New Hampshire.

For a more specific estimate find the calculator for your county. New Hampshire has one of the highest average property tax rates in the country with only two states levying higher property taxes. The statute imposing the tax is found at RSA 78-B and NH Code of Administrative Rules Rev 800.

The annual appreciation is an optional field where you can enter 0 if you do not wish to include it in the NH property tax calculator. The state and a number of local government authorities determine the tax rates in New Hampshire. Enter your Assessed Property Value Calculate Tax.

So if the assessed value of your home is 200000 but the market value is 250000 then the assessment ratio is 80 200000250000. The 2021 tax rate is 1503 per thousand dollars of valuation. This calculator is based upon the State of New Hampshires Department.

The average effective property tax rate in strafford county is 242. To calculate the daily interest charge you owe the state multiply the tax bill with 012 then divide by 365 for days in a single year. For example if.

2020 nh property tax rates.

Historical New Hampshire Tax Policy Information Ballotpedia

What You Should Know About Moving To Nh From Ma

New Hampshire Income Tax Nh State Tax Calculator Community Tax

New Hampshire Property Tax Calculator Smartasset

New Hampshire Income Tax Nh State Tax Calculator Community Tax

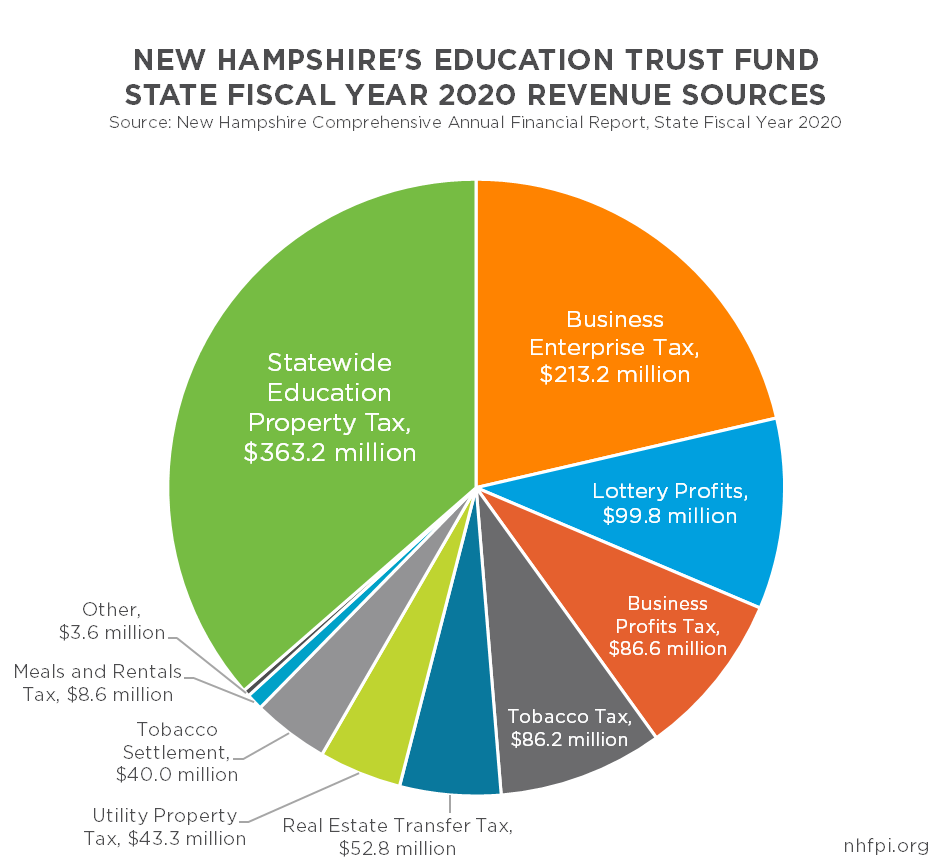

Proposed New State Property Tax Formula Unveiled To Nh School Funding Commission Nh Business Review

City Launches Online Property Tax Calculator To Help Estimate New Tax Bill Manchester Ink Link

The Ultimate Guide To New Hampshire Real Estate Taxes

New Hampshire Income Tax Nh State Tax Calculator Community Tax

Budget Replaces Targeted Aid With Tax Cut Disproportionately Benefitting Owners Of Higher Valued Properties Reachinghighernh

My Property Taxes Are What Understanding New Hampshire S Property Tax Milestone Financial Planning

New Hampshire Income Tax Nh State Tax Calculator Community Tax

How To Calculate Transfer Tax In Nh

The State Budget For Fiscal Years 2022 And 2023 New Hampshire Fiscal Policy Institute

Online Property Tax Calculator City Of Portsmouth